Car makers may need to take active measures to stabilise supply chains as they transition from Internal Combustion Engine (ICE) vehicles to Battery Electric Vehicles (BEVs),

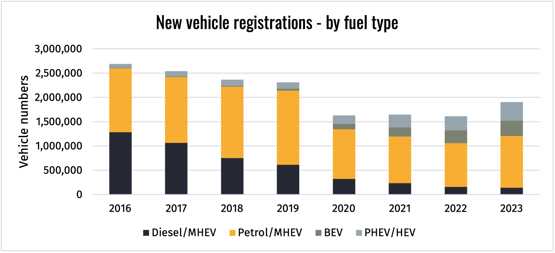

Lee Swinerd, director and head of automotive at financial advisory firm Interpath, in his latest analysis for Cox Automotive’s Insight Quarterly notes that the high costs associated with BEVs, coupled with persistent concerns over charging infrastructure, have dampened demand in key markets such as western Europe and North America.

In the UK, this complex landscape is further complicated by the political pressures and looming penalties under the Zero Emission Vehicle (ZEV) mandate, which is car makers to fast-track BEV adoption.

“The rush towards BEVs is creating a precarious situation for the ICE supply chain,” Swinerd explained. “While some level of softening in demand was anticipated, the growing unpredictability of production schedules is creating significant uncertainty for suppliers.

“Combined with post-COVID-19 production challenges, this is straining working capital and liquidity across the sector.”

Philip Nothard, insight director at Cox Automotive, added: “As BEV demand struggles to meet expectations, it raises critical questions about the future of ICE vehicles and the supply chains that support them. The fluctuating demand and supply dynamics for both ICE and BEVs necessitate strategic adjustments from both suppliers and OEMs.”

Swinerd further noted the challenges faced by suppliers who have already pivoted from diesel to petrol, only to now contend with reduced OEM investment and shrinking manufacturing capacity.

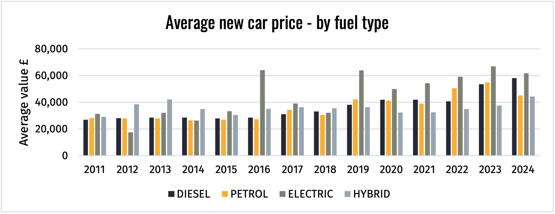

“The declining investment in ICE production is leading to ageing equipment and more frequent production downtimes, exacerbating the issue. OEMs may be forced to either absorb higher costs or pass them on to consumers, potentially making ICE vehicles more expensive,” he said.

The ongoing volatility underscores the need for strategic intervention from OEMs to stabilise supply chains and effectively manage the transition. This shift could result in reduced consumer choice for ICE vehicles as the industry increasingly focuses on BEVs.

Nothard warned of the continued stress on ICE component supply chains, stating: “The uncertainty around future ICE volumes, driven by weaker-than-expected consumer uptake of BEVs, will keep straining these supply chains. The industry must respond strategically, as imposing an additional £15,000 cost uplift on new vehicles to cover penalties if ICE targets are missed is simply not viable.”