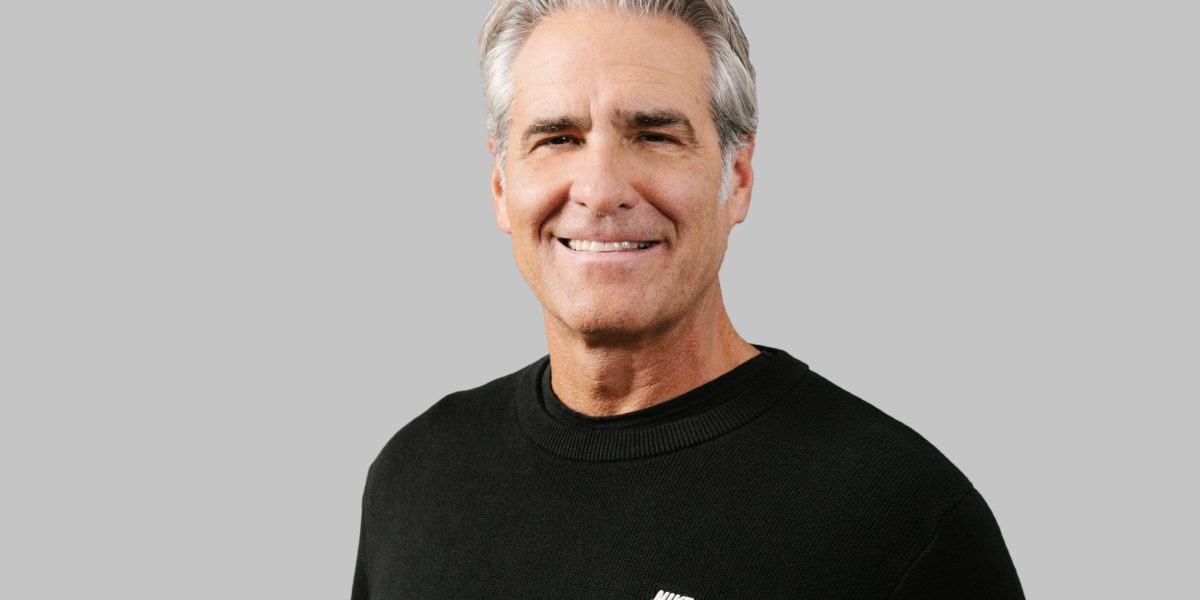

Nike veteran Elliott Hill is no stranger to a Monday morning at the $122 billion sportswear giant. The only difference is this week, he’s leading the company.

Hill already has a pile of issues in his metaphorical in-tray: new product launches, a desperate need for innovation, softening sales in certain regions and a share price which has had a bumpy year to say the least.

But Hill can have some confidence.

Markets were buoyed by the news that he was taking on the title of CEO, with analysts viewing the change of management as favorable rather than indicative of tough times ahead.

After all, the 60-year-old executive knows the business inside out. Hill began at Nike as an intern and over more than 30 years worked his way up to president of the consumer and marketplace decision.

In 2020, Hill made a go of retirement, but after four years, the habit hasn’t stuck: he’s back at the business where he’s spent the vast majority of his career.

When Nike announced the return of its veteran talent on September 19, the company’s share price jumped 7$ from $81 a share to $86.52.

Analysts at Barclays explained the market’s optimism, writing in a note seen by Fortune: “We view the announcement favorably, especially with the return of Elliot Hill … and while it will take time to materialize in results, we believe the hiring of a long-time Nike veteran will help reignite a company-wide focus on product innovation, serving its consumers across marketplaces and geographies.

“We do not view the announcement as a signal that the upcoming quarter is worse than expected, and view this management change as largely expected by investors and a positive development given the company performance.”

Problem number one: Innovation

Nike needs some buzzy new products on the shelves, and it needs them fast.

For better or worse, competitors like Adidas have released collections with Yeezy—faced by embattled entertainer ‘Ye,’ also known as Kanye West.

Adidas has also been buoyed by demand for launches of their Samba and Gazelle lines, reporting this summer that operating profits for the first half of the year ended June 30 were €682 million—up nearly 190% from the same period a year ago.

Nike is not enjoying similar fortunes. For its Q1 2025 results ending August 31, Nike reported revenues of $11.6 billion, down 10% on a reported basis.

Barclays notes that Nike’s “once-clean inventory” has “suddenly reversed.” The financial institution wrote that this is “in part due to Nike’s aggressive franchise management strategy of its legacy franchises, such as the AF1, AJ1, and Dunks, that they believe have been overextended into the marketplace.”

Barclays added: “The rapid and significant loss of sales, which is yet to be replaced by new product, creates significant fixed-cost deleverage.”

Problem number two: China

Nike isn’t alone in struggling to attract consumers in China.

Economic conditions are tough—despite a raft of fiscal stimulus announced by the government—with luxury brands and discount retailers alike struggling to drive sales.

Goldman Sachs identified the Chinese macroeconomic outlook as one of the key issues facing Nike in its most recent analysis of the brand.

In June, equity specialists Brooke Roach, Evan Dorschner, Savannah Sommer, and Mentesnot Adamu issued a ‘buy’ rating on Nike and updated its FY25/FY26 EPS estimates downwards from $3.85/$4.32 to $3.25/$3.76.

In addition to citing the muted China outlook as a threat to Nike, Goldman also identified ” an intensification of sportswear market competitive intensity or lack of success of new product innovation, wholesale channel pressures, inventory management and promotional, slower recapture of transitory margin pressures.”

Problem three: Culture

Earlier this year, Nike reportedly began a cost-cutting scheme to axe $2 billion in spending from the business.

This meant layoffs—even in the business’s mysterious Department of Nike Archives (DNA) team tasked with preserving artifacts important to the brand’s history.

On a December earnings call, Nike’s finance boss, Matt Friend, outlined cost-cutting measures that would include “simplifying our product assortment, improving supply-chain efficiency, leveraging our scale to lower the marginal cost of operations, increasing automation and speed from data and technology, streamlining our organizational structure, reducing management layers, and enhancing our procurement capabilities.”

A matter of months later, Reuters reported the brand was planning to cut 2% of its 80,000-plus staffers. By June, some 740 roles will have been eliminated in what management has called the “second phase of impacts.”

Layoffs mean cultural turbulence at any business, with staffers wondering if their roles are secure.

So, Nike staffers might be pleased to see one of their own coming back into the fold, particularly when Hill made a point to highlight teamwork and relationship building as one of the main areas of focus for his tenure.

“For 32 years, I’ve had the privilege of working with the best in the industry, helping to shape our company into the magical place it is today,” said Hill said in a statement accompanying the news he was incoming CEO.

In the September memo, he added: “I’m eager to reconnect with the many employees and trusted partners I’ve worked with over the years and just as excited to build new, impactful relationships that will move us ahead.”